Chicago’s plan to ease its $20 billion public-worker pension deficit was ruled illegal by the Illinois Supreme Court, a decision that the city warned may lead to the funds’ running out of money and worsen its financial strains.

The Chicago plan, passed in 2014, violates the Illinois Constitution, which bars the diminishing of public pensions, the court said Thursday. The finding upholds a lower court decision from July and follows a similar ruling by the Illinois Supreme Court last May preventing changes to the state’s pension funds.

“It’s disappointing, but not unexpected,” said Paul Mansour, head of municipal research at Conning, which oversees $11 billion of state and local debt, including Chicago securities. “It will take longer to bring these costs under control absent the ability to enact common sense reforms that were negotiated.”

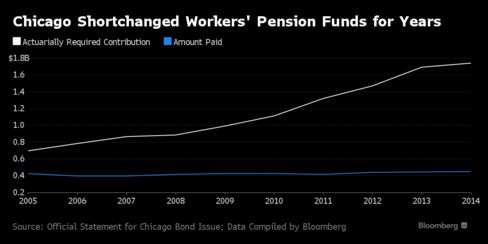

The city, the third-largest in the nation, shortchanged its pensions over the last decade, creating a shortfall that’s left it with a lower credit rating than any big U.S. city except once-bankrupt Detroit. Under the now void law, its projected annual payment of $886 million due this year to its four retirement funds was more than twice what it was a decade ago, spurring officials to adopt a record property-tax increase to ease the impact on the budget.

The ruling in the Chicago case impairs Mayor Rahm Emanuel’s efforts to pare a deficit that threatens the city’s solvency. The defeat leaves officials racing to devise new ways to shore up retirement system, though it will also save money in the short term because the overhaul required the city to boost contributions to its municipal and laborers funds. The two cover about 60,000 workers and retirees.

“My administration will continue to work with our labor partners on a shared path forward that preserves and protects the municipal and laborers’ pension funds, while continuing to be fair to Chicago taxpayers and ensuring the City’s long-term financial health,” Emanuel said in an e-mailed statement.

Workers hailed the decision for eliminating the risk that promised benefits will be scaled back. “Today’s ruling strengthens the promise of dignity in retirement for those who serve our communities, and reinforces the Illinois Constitution, our state’s highest law,” city unions said in a joint statement.

The court’s ruling comes almost 11 months after it unanimously struck down a 2013 lawto alter Illinois’s retirement system, saying the changes to solve the state’s $111 billion pension shortfall violated constitutional protections of workers’ benefits. That holding led Moody’s Investors Service to cut Chicago’s credit rating to junk in May, citing the increased risk that the city’s law would also be thrown out.

Moody’s, which has a negative outlook on Chicago’s Ba1 rating, one step below investment grade, said it would continue to assess its plans to fix pensions in the wake of the ruling.

Ruling Expected

Before the ruling, Moody’s said the city could get hit with another downgrade if the court sided with unions and officials don’t develop and enact an alternate plan. Unlike cities such as Detroit, Chicago can’t file for bankruptcy protection to cut its debts because Illinois law doesn’t allow it.

There was little trading in Chicago bonds after the verdict, which investors had predicted would not go in the city’s favor.

The ruling was an “expected setback for the city,” said John Miller, co-head of fixed income in Chicago at Nuveen Asset Management, which oversees about $110 billion in munis, which includes Chicago debt. The city has a growing and diverse economy, he said, citing increasing corporate relocations and a rise in assessed valuations among other positives.

“They have time and they have strength to pull from,” Miller said. “I think other reform models that could pass muster are still being worked on. They tried one type, and that one type didn’t work, so they got to try another model.”

Chicago argued that its plan was different from the state version because it increased city funding of the municipal workers’ and laborers’ pension funds, essentially protecting benefits by ensuring the funds don’t go broke. The plans for fire and police retirees weren’t covered by the overhaul.

Accrued benefits shouldn’t be changed, Illinois Governor Bruce Rauner told reporters on Thursday. He reiterated the importance of his agenda, stalled in the Democrat-led legislature, to bolster the state economy through limits on unions and property tax relief.

“I’m not going to bail out Chicago, but our reforms structurally will allow Chicago to solve a lot of its own problems,” Rauner said.

The affected plans cut future cost-of-living raises. Lawyers for unions sued the city, arguing that any reduction in benefits was illegal. The court agreed.

“The statutory funding provisions are not a ‘benefit’ that can be ‘offset’ against an unconstitutional diminishment of pension benefits,” the opinion reads.

The city’s measures were intended to make the laborer and municipal worker pensions 90 percent funded by the end of 2055. The municipal workers’ pension was only 42 percent funded, and the laborers only 64 percent funded, at the end of 2014, citydocuments show.

Unfunded liabilities are increasing each day by an average of $2.48 million, city lawyers said in court papers. One fund will be out of money within 10 years, the other in 13, they said. The court rejected that as a justification for reducing benefits.

“To put it simply, in 10 years, the members of the Funds will be no less entitled to the benefits they were promised,” the opinion reads. “Thus the ‘guaranty’ that the benefits due will be paid is merely an offer to do something already constitutionally mandated by the pension protection clause.”

The case is Jones v. Municipal Employees Annuity and Benefit Fund of Chicago, 119618, Supreme Court of Illinois (Springfield).