With CalPERS sitting on $170 billion of pension debt created by 17 years of underfunding, we CalPERS pensioners deserve some answers.

Will this finally be the year that the California Public Employees’ Retirement System board proves that getting full funding is more important than keeping public employee unions happy?

Will this be the year that the CalPERS board meets its fiduciary duties as required by the state Constitution by placing retirement security first?

Will this be the year that the CalPERS board accepts financial reality and reduces its assumed rate of return?

As a CalPERS pensioner, I want to be paid every penny I have earned. I want the money for the benefits earned by all CalPERS members placed in a trust fund where no bankruptcy court can take it. Unfortunately, CalPERS is short of what should have been set aside. Way short.

In 1999 CalPERS had a surplus. Today, it has a debt larger than the state’s annual budget.

One of the most important decisions the CalPERS board makes is an assumption about future investment returns. The higher the earnings assumption, the less money gets paid into the fund each year by employees and employers. If the earnings fall short, the pension debt goes up.

The CalPERS Board now assumes the fund will earn a 7.5 percent return on investments indefinitely — despite a contrary view of its own investment experts, Wilshire Associates, who predict an average of 6.4 percent return over the next 10 years.

BNY Mellon recently predicted an average return of 5.8 percent for public pension funds. Super-investor Warren Buffet thinks 6 percent is the right long-term investment estimate for public pension funds, and the U.S. Treasury Department rejected the Teamsters Central States pension fund’s 7.5 percent figure, saying 6.43 percent was the consensus 10-year prediction.

So why does CalPERS pursue this underfunding strategy? It keeps employee contributions low and leaves more money available for salary increases. By lowering the employee’s contribution rate, the risk and debt is transferred to the taxpayers. The public employee unions controlling CalPERS love that approach.

As the CalPERS board pursues its underfunding strategy, the pension debt gets bigger and bigger, the cost to pay it goes up and up, and government agencies’ ability to pay gets squeezed tighter and tighter. Pension debt will force some cities into bankruptcy. But CalPERS will not be there to resuscitate a city. Under state law, CalPERS cannot cover the pension obligations of a distressed city. That’s a local taxpayer responsibility.

If the money for CalPERS benefits has been fully paid, the employees and retirees of a bankrupt city have little to worry about. If not, those city employees and retirees must fight in bankruptcy court and hope for the best.

They might fare as well as the employees and retirees of Vallejo, Stockton and San Bernardino, who lost only their health care benefits. But they might suffer pension benefit cuts like those in Central Falls, R.I., and Detroit.

It’s time for CalPERS to put plan participants and their beneficiaries first.

It’s time for CalPERS to stop its underfunding strategy that increases long-term employer contributions. It’s time for CalPERS to minimize employers’ costs of providing benefits as required by state law.

It’s time for the CalPERS board to put fiduciary duties ahead of political calculations.

It’s time for public employees and retirees to demand full funding of pension obligations.

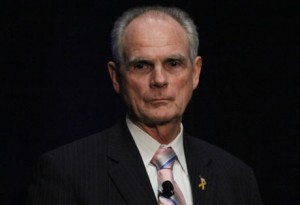

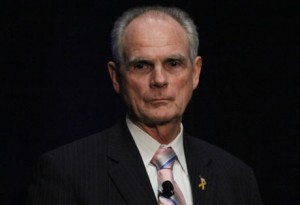

Chuck Reed, former mayor of San Jose, is a board member of the Retirement Security Initiative, a national, bipartisan advocacy organization focused on protecting public sector retirement plans.